MJNA Stock Predictions 2025: A Comprehensive Analysis

Predicting the future performance of any stock, especially one in a volatile sector like cannabis, is fraught with uncertainty. However, understanding the factors influencing the market and company-specific dynamics can provide valuable insights. This article delves into MJNA stock predictions for 2025, exploring the potential scenarios and the underlying drivers that could shape its trajectory. We will examine market trends, company performance, regulatory landscapes, and expert opinions to offer a comprehensive perspective on what investors might expect from MJNA stock in the coming years.

Understanding MJNA and the Cannabis Market

Before diving into specific predictions, it’s crucial to understand the company behind the stock and the broader market in which it operates. Medical Marijuana, Inc. (MJNA) is a company focused on developing and distributing cannabis-based products. The cannabis industry itself has experienced significant growth and volatility, driven by changing regulations, increasing consumer acceptance, and expanding applications in medicine and recreation.

Factors Influencing MJNA Stock Performance

Several factors can influence MJNA’s stock performance, including:

- Regulatory Changes: The legal status of cannabis varies widely across different jurisdictions. Changes in regulations, such as legalization or stricter controls, can significantly impact the company’s operations and market access.

- Market Demand: Consumer demand for cannabis products is a key driver of revenue growth. Shifts in consumer preferences, new product innovations, and the overall economic climate can affect demand.

- Competition: The cannabis market is becoming increasingly competitive, with new players entering the space and established companies expanding their reach. MJNA’s ability to differentiate itself and maintain market share is crucial.

- Financial Performance: The company’s revenue, profitability, and cash flow are key indicators of its financial health. Strong financial performance can boost investor confidence and drive stock appreciation.

- Global Expansion: The ability to expand operations into new markets, especially international ones, can significantly impact the growth potential of MJNA.

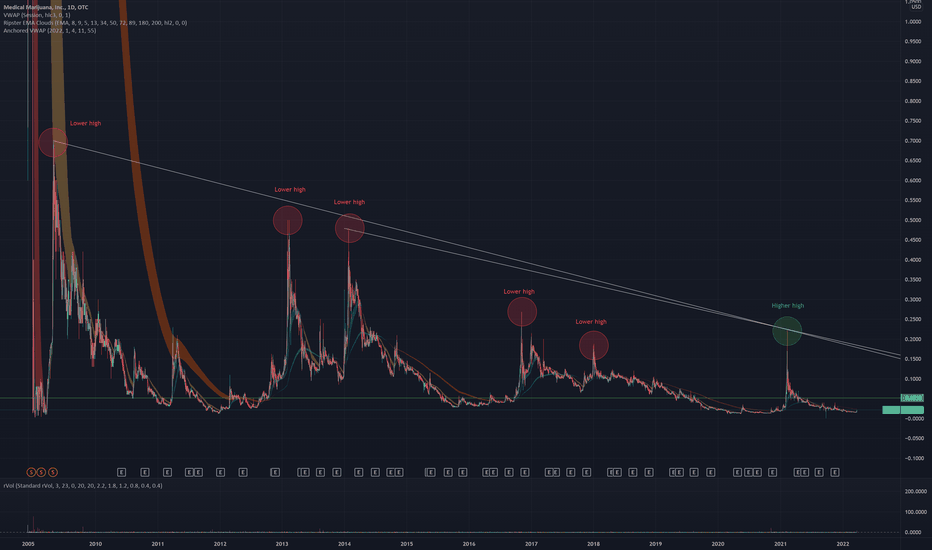

Analyzing MJNA’s Historical Performance

Reviewing MJNA’s past performance can provide some context for future expectations. However, it’s important to remember that past performance is not necessarily indicative of future results. Factors such as market conditions, regulatory changes, and company-specific strategies can change over time.

Looking at historical data, it’s essential to analyze the company’s revenue growth, profitability, and stock price volatility. Consider any significant events or milestones that may have impacted the stock’s performance, such as product launches, acquisitions, or regulatory changes. Understanding these historical trends can help investors better assess the risks and opportunities associated with MJNA stock.

Expert Opinions and Analyst Ratings

While definitive MJNA stock predictions for 2025 are impossible, consulting expert opinions and analyst ratings can provide valuable insights. Financial analysts often conduct in-depth research on companies and industries, offering projections on future earnings, revenue growth, and stock price targets.

It’s important to consider the source of these opinions and ratings. Look for reputable analysts with a proven track record of accuracy. Also, be aware that analyst ratings are not guarantees of future performance, and they should be considered as just one piece of information in your overall investment decision-making process. Always conduct your own due diligence and consider your own risk tolerance before making any investment decisions related to MJNA stock.

Potential Scenarios for MJNA Stock in 2025

Given the uncertainties surrounding the cannabis market and MJNA’s future performance, it’s helpful to consider several potential scenarios for MJNA stock in 2025:

Bullish Scenario

In a bullish scenario, the cannabis market experiences continued growth, driven by further legalization and increasing consumer demand. MJNA successfully expands its market share, launches new innovative products, and achieves strong financial performance. This could lead to significant stock appreciation, with the stock price potentially reaching higher levels than current estimates. Key factors driving this scenario include favorable regulatory changes, successful product innovation, and effective marketing strategies.

Base Case Scenario

In a base case scenario, the cannabis market experiences moderate growth, with some regulatory hurdles and increased competition. MJNA maintains its market share and achieves steady financial performance. The stock price experiences moderate growth, reflecting the overall market conditions and the company’s performance. This scenario assumes a balanced mix of positive and negative factors, with no major disruptions to the industry or the company’s operations.

Bearish Scenario

In a bearish scenario, the cannabis market faces significant challenges, such as stricter regulations, declining consumer demand, and increased competition. MJNA struggles to maintain its market share, experiences financial difficulties, and faces legal or regulatory challenges. This could lead to a decline in the stock price, potentially falling below current levels. Factors contributing to this scenario include unfavorable regulatory changes, unsuccessful product launches, and ineffective management strategies.

Risks and Challenges Associated with MJNA Stock

Investing in MJNA stock, like any investment, involves risks and challenges. Some of the key risks associated with MJNA include:

- Regulatory Risk: The legal status of cannabis is constantly evolving, and changes in regulations can significantly impact the company’s operations.

- Competition Risk: The cannabis market is becoming increasingly competitive, with new players entering the space and established companies expanding their reach.

- Financial Risk: The company’s financial performance can be affected by various factors, such as market conditions, competition, and operational challenges.

- Operational Risk: The company’s operations can be disrupted by various factors, such as supply chain issues, production problems, and legal or regulatory challenges.

- Market Risk: Overall market conditions, such as economic downturns or changes in investor sentiment, can impact the stock price.

Key Metrics to Watch

To track MJNA’s performance and assess the validity of MJNA stock predictions for 2025, investors should monitor key metrics such as:

- Revenue Growth: Track the company’s revenue growth to assess its ability to expand its market share and generate sales.

- Profitability: Monitor the company’s profitability to assess its ability to generate profits and manage its expenses.

- Market Share: Track the company’s market share to assess its competitive position in the cannabis market.

- Regulatory Developments: Stay informed about any changes in regulations that could impact the company’s operations.

- Product Innovation: Monitor the company’s product development pipeline to assess its ability to launch new and innovative products.

Alternative Investment Options

Before investing in MJNA stock, investors should consider alternative investment options, such as other cannabis stocks, ETFs, or mutual funds. Diversifying your portfolio can help reduce risk and improve overall returns. [See also: Diversifying Your Cannabis Portfolio] Research different investment options and consider your own risk tolerance and investment goals before making any decisions.

Conclusion: MJNA Stock Predictions 2025 – A Balanced Perspective

While definitive MJNA stock predictions for 2025 are impossible, analyzing market trends, company performance, regulatory landscapes, and expert opinions can provide valuable insights. Investors should consider various potential scenarios, assess the risks and challenges associated with MJNA stock, and monitor key metrics to track the company’s performance. Remember to conduct your own due diligence and consult with a financial advisor before making any investment decisions. The future of MJNA stock, like the cannabis industry itself, remains subject to considerable uncertainty, requiring a balanced and informed investment approach.

Ultimately, the accuracy of any MJNA stock predictions for 2025 will depend on a complex interplay of factors, many of which are difficult to foresee. A well-informed and cautious approach is essential for navigating the uncertainties of the cannabis market and making sound investment decisions related to MJNA.